Okida Finans AS is a Norwegian company operating in fintech. Their business model is to offer private individuals in Norway loans from several different banks through web-based tools. The business’s business-critical tools, both loan brokerage and processing, are cloud-based. The loan processing includes fast and efficient communication with both loan applicants and banks.

Since 2018, Provide IT has been Okida’s strategic digital agency, this has meant that we have created their digital infrastructure, which includes their website and CRM system with integration with several different banks.

Background

Since 2016, we have carried out several assignments in fintech – towards both digital banks and loan brokers. Based on references, Okida contacted us with the goal of digitizing their operations.

For Okida, it was necessary to have anew CRM system and a website to increase revenue but also reduce the processing time for loan applications.A task that requires knowledge in strategy, UX/UI design and system development.

The assignment

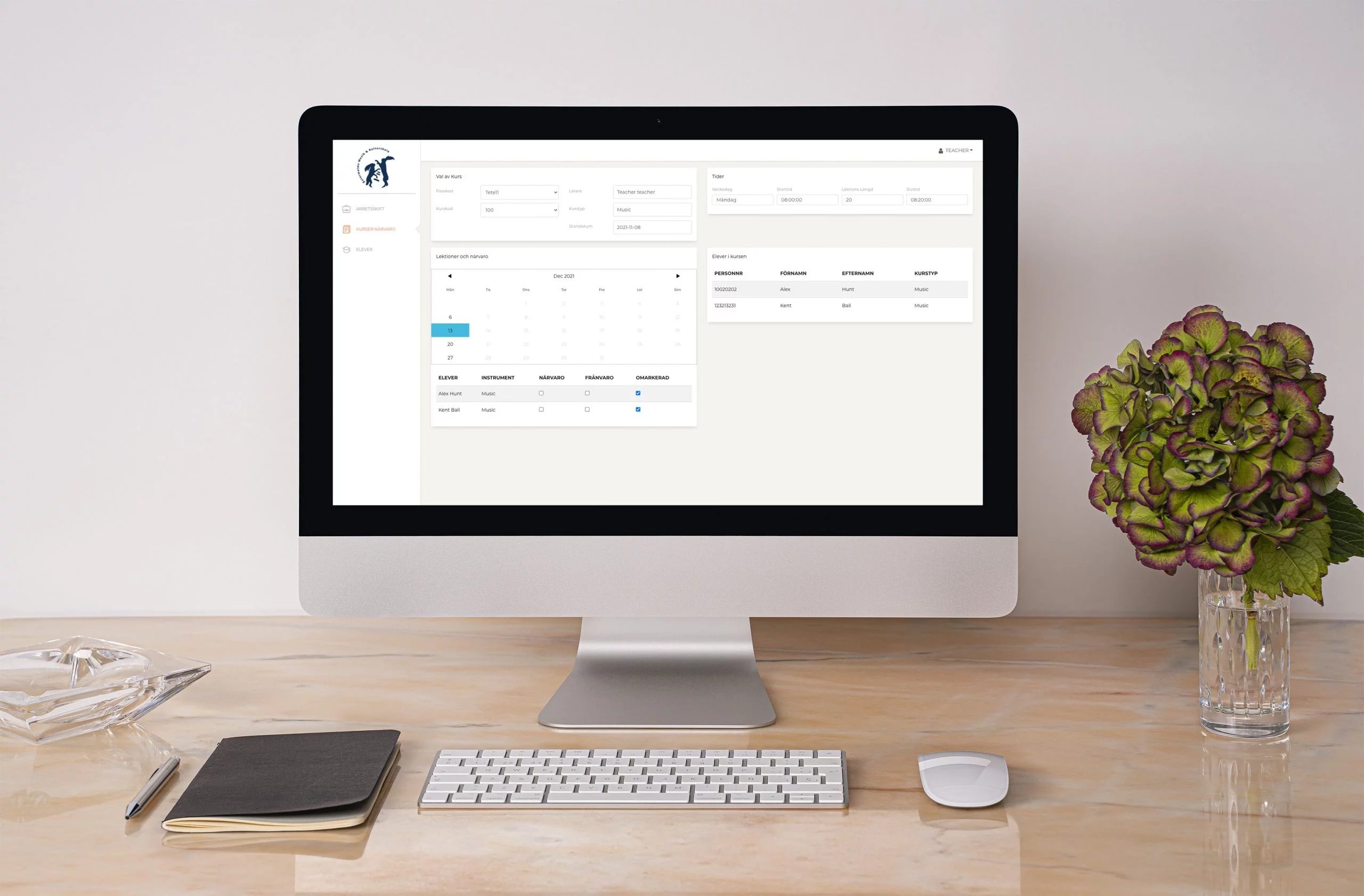

Together with Okida, a flowchart was created that involves communication between primarily three parties. The first is private individuals who come into contact with the website to apply for loans. As well as Okida’s administrators who receive the loans via an API between the website and the CRM system. And finally the banks that offer loans to the private individual through the CRM system that is integrated with the bank’s own system. In addition, all communication with the private individual takes place via Okida’s CRM system.

Based on an understanding of Okida’s requirements and wishes, Provide IT carried out preliminary work to establish a requirements specification and a technical solution proposal. Ultimately, we suggested that the website be developed in WordPress and the CRM system in the well-known PHP framework Laravel. These two technologies are recommended based on the evaluation criteria of sustainability, flexibility and cost-effectiveness.

Initially, the first version of the CRM system was developed and since then several different projects have been carried out to further develop the web solutions.

The Future

Provide IT continues to manage, design and further develop Okida’s website and CRM system today. The goal is to have the leading technology within loan brokerage in Norway. This means high demands on user-friendliness and technology to increase the conversion of visitors to customers via the website, as well as streamline the processing time for loans in the CRM system.

You can visit Okida’s websitehere.

The appearance of the CRM system is confidential.

What we did

Digital strategy, systems development, design, integration & management

Share